Most Americans Will Need Long-Term Services and Supports in Their Lifetimes; Many Will Face Economic Hardship as a Result

People may not like to think about it, but most Americans will need long-term services and supports (LTSS) in their lifetimes, usually in older age. And for some, the financial burden of needed care will be significant, with out-of-pocket costs that total in the tens or even hundreds of thousands of dollars. Public policy, therefore, is necessary to ensure LTSS access and affordability for all Americans, especially those with low and middle incomes.

Most people will need LTSS and many will have out-of-pocket costs

LTSS includes a wide range of assistance with daily activities for people who cannot perform them on their own due to a physical, cognitive, or chronic health condition. A recent analysis for the HHS Assistant Secretary for Planning and Evaluation by Richard Johnson and Judith Dey estimates that 56% of people turning 65 between 2021 and 2025 will need LTSS in their lifetime. In addition, millions of people need (or will need) LTSS before they reach age 65.

Half of the 8 million Americans with current LTSS needs in 2022 were under age 65.

On average, Johnson and Dey project that people turning 65 will have about three years need for assistance with daily activities. Less than one year of these services, on average, are paid LTSS—the rest is provided by unpaid caregivers like friends and family—but experiences will vary widely among individuals. Some individuals will have no LTSS need, while others will have LTSS need that is much greater than the average.

Family and other unpaid caregivers provide the majority of day-to-day support with daily activities for the older population and are expected to continue to do so. However, nearly half of older people will also get formal or paid LTSS at some point, and the majority of those will have to pay at least partially out of pocket. Looking across the entire cohort, Johnson and Dey predict that:

- more than half (56%) of people turning 65 from 2021-2025 will need LTSS;

- nearly half (45%) will need paid LTSS;

- about one-third (35%) will have some out-of-pocket costs; and

- and one in seven (14%) will incur out-of-pocket costs of more than $100,000.

Family caregivers currently provide the majority of assistance with daily activities

In 2021, the estimated economic value of family caregiving for people with LTSS needs was $600 billion, considerably larger than the total expenditure on formal, paid care. In the same year, paid LTSS and post-acute services totaled $467 billion, including $333 billion in public spending and $134 billion in private pay expenditures.

Medicaid is the single largest payer of paid LTSS, but most people with LTSS needs are not eligible or not enrolled in the program, and even those who are may not always receive all of the care they need. Medicaid eligibility is limited to those with low incomes and few assets, or who exhaust their financial resources paying for care and “spend down” to eligibility. Medicare and private health insurance generally do not pay for LTSS, or else have a very limited benefit. Therefore, family caregivers and private pay are very often the only options for people with LTSS needs.

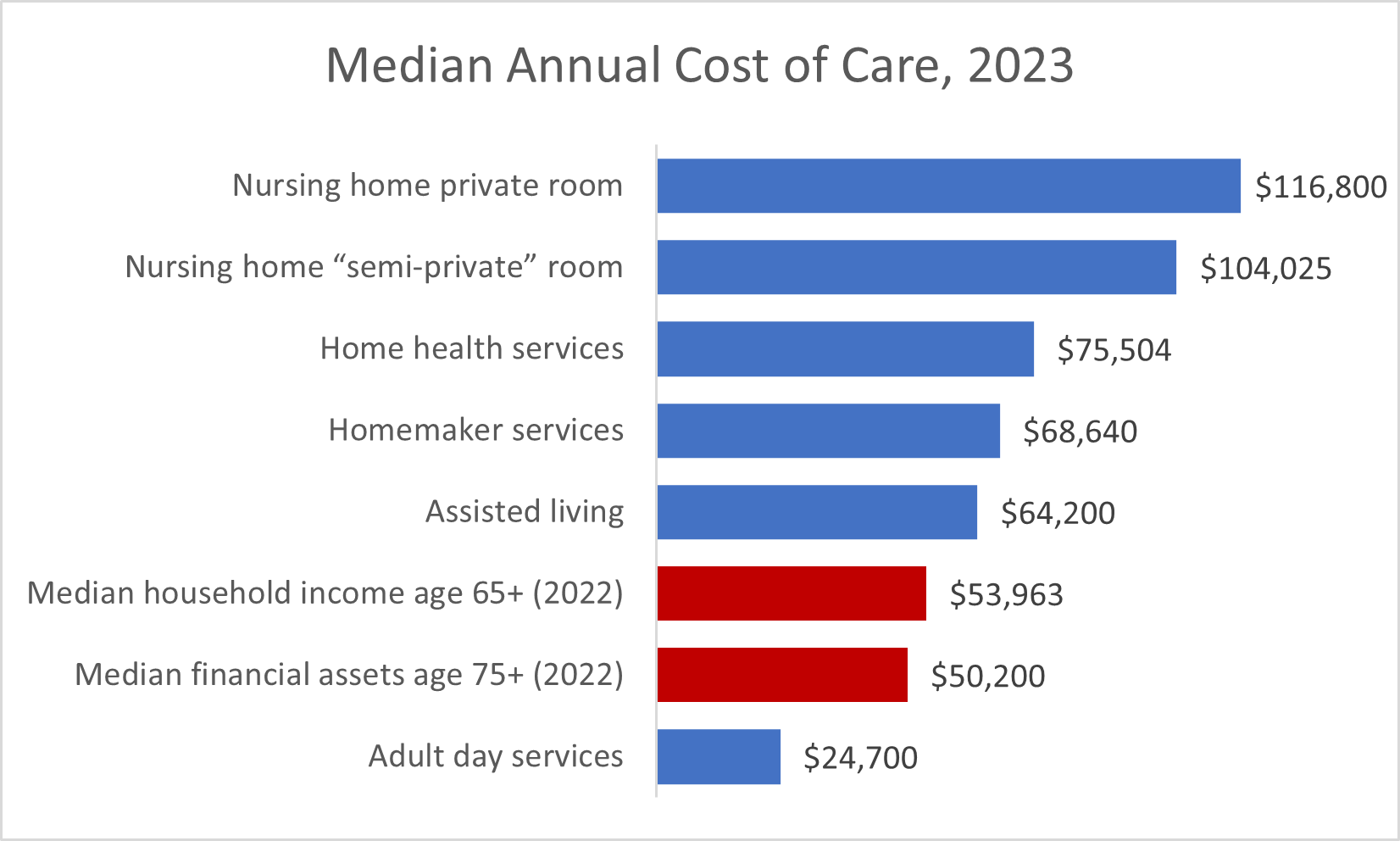

Annual private pay costs of LTSS exceed the typical income and assets of older households

Paying for LTSS out of pocket can quickly exhaust the savings of the average family. Typical annual private pay costs in 2023 ranged from about $25,000 for adult day services (non-residential services provided outside the home for less than a full day) to more than $100,000 for nursing home care. By comparison, in 2022, the median household income for an age 65+ household was $54,000 (and that household may contain two or more people). The median total financial assets (bank accounts, retirement savings, stocks and bonds, etc.) for an age 75+ household were just $50,000. Thus, nursing home care, home care, and assisted living are unaffordable for a typical family that doesn’t have coverage through Medicaid.

Source: Genworth Cost of Care Survey (LTSS costs), US Census Bureau (income), Federal Reserve (assets)

Private pay affordability of LTSS has been a key component of AARP’s LTSS State Scorecard, which finds that the relative affordability (or unaffordability) of services varies significantly between states. The Scorecard includes indicators measuring the cost of home care and nursing home care relative to the median household income of older adults.

The most recent Scorecard, released last fall, shows that the median cost of 30 hours per week of home care in the three least affordable states (Minnesota, South Dakota, and Maine) exceeded the median income of older households, compared to 63% of median household income in the relatively most affordable states of Hawaii and Maryland.

For nursing home care, state differences in affordability were even greater, with annual cost for a private room ranging from about 1.5 times the median income of an older household in Missouri to over three times the median income in five states. The least affordable states were West Virginia (3.5 times median income) and Alaska (6 times median income).

Public policy needs to better protect individuals from the risk of needing costly LTSS

Without robust public or private insurance protection for long-term services and supports beyond Medicaid, LTSS need is a major financial risk for all Americans without significant wealth. Most older people with LTSS needs avoid significant financial impact through a combination of relatively short duration of need and support from family and friends, but a substantial percentage have costs that may exhaust or even exceed their life savings. This expense can affect their own quality of life in their later years and impact the financial security of their children and grandchildren due to having to pay for care or having to provide more of the care themselves.

While strengthening the Medicaid LTSS safety net is critical for those with low incomes and few assets, the answer is not just Medicaid alone. Middle class families, whose financial resources disqualify them from public assistance, are also at significant risk of needing care that they cannot afford. As the population continues to age and policymakers consider LTSS in the coming years, it will be critical to ensure access and affordability for all older adults and their families.